WILLEMSTAD/PHILIPSBURG:--- The current exchange rate arrangement of the monetary union of Curaçao and Sint Maarten has been a regular subject of debate over the years. The country packages of reforms (Landspakketten) for Curaçao and Sint Maarten brought the topic back to the fore. The packages included the requirement that a study be done by an independent party on the societal costs of their own currency versus dollarization. This study is included in the Staff Report of the IMF’s 2021 Article IV Consultation of Curaçao and Sint Maarten. Considering the current interest in the topic, the Centrale Bank van Curaçao en Sint Maarten (CBCS) has published a position paper that provides an in-depth analysis on the benefits and costs associated with adopting the United States (U.S.) dollar as official currency, i.e., dollarization. Particularly in Sint Maarten, the issue of dollarization as an alternative to the current arrangement is frequently mentioned because the U.S. dollar widely circulates and is de facto accepted as a means of payment for goods and services.

The CBCS’s position paper provides an extensive overview of various exchange rate systems. It explains the differences between a conventional peg, such as the one currently in use by the monetary union of Curaçao and Sint Maarten, a floating exchange rate system, and full dollarization, i.e., when a country adopts the U.S. dollar as legal tender. Furthermore, the paper provides detailed examples of countries that have dollarized and the reasons that led to that decision, along with descriptions of the advantages and disadvantages they experienced with such an arrangement.

In essence, an exchange rate is the relative price of one currency in terms of another currency or group of currencies. It is an important factor that influences economic activity, inflation, and the balance of payments. Therefore, the choice and management of the exchange rate regime are critical to safeguarding competitiveness, macroeconomic stability, and growth. For small and open economies, a conventional peg is an often-chosen exchange rate arrangement. The choice of the U.S. dollar as an anchor currency in Curaçao and Sint Maarten is explained by the strong trade relation with the United States, which counts even stronger for Sint Maarten than for Curaçao. In addition, most of the international transactions in both countries are executed in U.S. dollars. Countries with such an exchange rate system manage their external trade by having sufficient stock of foreign

reserves, such as U.S. dollars, at the central bank to guarantee the smooth settlement of international payments, among other things. In the case of the monetary union, reserves adequate to cover at least 3 months of imports is the generally accepted guideline.

The Netherlands Antillean guilder (NAf.) has been successfully pegged to the U.S. dollar since 1971 at NAf. 1.79 per dollar. This has not changed after the dissolution of the Netherlands Antilles in 2010, and the conventional peg of the guilder to the dollar remained the exchange rate regime in the monetary union between the countries of Curaçao and Sint Maarten. The peg has remained strong as indicated by an import coverage (i.e., ratio of the union’s total import of goods and services and the official reserves excluding gold) that has remained well-above the norm of 3 months.

Countries that chose to dollarize are either microstates or countries that went through great economic distress. There is a vast amount of literature on the benefits and costs of dollarization. One of the main benefits of dollarization is the elimination of the risk of exchange rate adjustments, i.e., currency risk, leading to lower interest rates and more stable international capital movements, which could stimulate investment and economic growth. Another benefit is the reduction in transaction costs in trade and capital flows because there is no need for currency conversion toward the anchor currency. In addition, dollarization may result in price stabilization, while inflation tends to converge to the inflation rate in the anchor currency’s country. Finally, dollarization encourages fiscal discipline by constraining monetary financing, i.e., printing money, of fiscal deficits.

One of the main costs of dollarization is that the possibility of conducting independent monetary and exchange rate policy is completely ceded. To absorb external shocks, the dollarized economy must resort to adjustments in nominal wages and certain prices. Another cost of dollarization is the loss of seigniorage rights, i.e., the profit accruing to the monetary authority from its right to issue currency.1 Finally, the monetary authority loses its ability to function as lender of last resort2 for banks in distress.

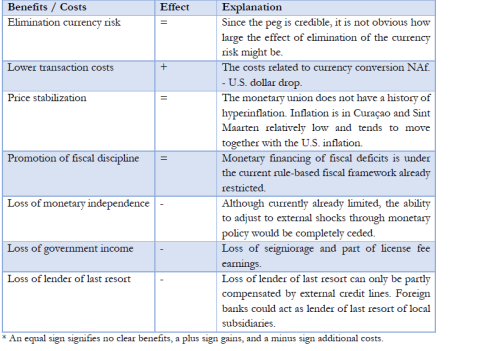

In the case of the monetary union of Curaçao and Sint Maarten, dollarization would not likely yield significant economic benefits whereas the costs and in particular the transition risks are real. The benefit from the elimination of currency risk is limited given our credible peg for 50 years now. Inflation is already relatively low and stable and tends to move in-line with U.S. inflation. In addition, dollarization will not alter the responsibility of both countries’ governments to adhere to the strict budgetary rules as laid out in the Kingdom Act on Financial Supervision. On the other hand, the loss of the monetary policy instrument, government income from seigniorage and license fees, and the lender of last resort function is evident. Hence, there is no compelling or urgent economic reason for the countries to dollarize. The included table compares the main benefits and costs of dollarization versus the current conventional peg for the monetary union of Curaçao and Sint Maarten.

1 This profit is generated because of the difference between the face value and the production costs of banknotes.

2 Providing liquidity to banks in trouble.

Ultimately, the decision to dollarize is a political one, but one that should be taken only after careful consideration and understanding of the underlying macroeconomic fundamentals and necessary institutional, operational, and structural reforms. After all, since the guilder to dollar peg was established, neither the Netherlands Antilles nor the current monetary union has experienced instances of exchange rate adjustments.

Comparison benefits and costs of dollarization vis-à-vis the current peg.