~ VIDANOVA plans to close deal in 60 days if PJIAE accepts $240M loan.~

~ VIDANOVA plans to close deal in 60 days if PJIAE accepts $240M loan.~

PHILIPSBURG:--- On the second anniversary of IRMA St. Maarten’s Airport management through the Minister of TEATT Stuart Johnson got a golden opportunity from VIDANOVA and JPF where parties presented the Minister and the management board of PJIAE with a loan project for the Princess Juliana International Airport (PJIAE).

The lenders proposed a loan to PJIAE some $240M that can be finalized within 60 days, basically by November 11th, 2019 (St. Maarten’s Day.)

The planned project includes buying out the $93M bondholders and the $20M that the Government loaned PJIAE in bridge loan. This $20M was given to St. Maarten Government through the World Bank.

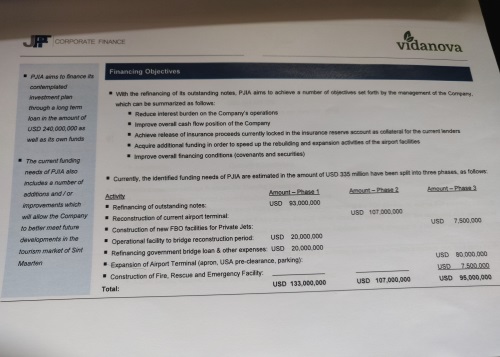

The plan presented to the Minister and PJIAE entails 3 phases, which are as follows:

• To buy out the bondholders that are holding PJIAE hostage for $93M as well as the $20M bridge loan given to PJAIE also another $20M in working capital or bridge loan.

• Reconstruction of the PJIAE terminal building for $107M.

• Expansion of PJAIE to the tune of $95M.

The presentation shows that these financiers namely VIDANOVA through JPF will negotiate with the bondholders and to immediately buy them out through local financing both locally and Curacao. Possibilities that no one explored over the two year period since the passage of Hurricane IRMA and MARIA, clearly the proposal made to the Government of St. Maarten through VIDANOVA and JFP shows that St. Maarten could have acquired money to rebuilds its airport way sooner.

The presentation shows that these financiers namely VIDANOVA through JPF will negotiate with the bondholders and to immediately buy them out through local financing both locally and Curacao. Possibilities that no one explored over the two year period since the passage of Hurricane IRMA and MARIA, clearly the proposal made to the Government of St. Maarten through VIDANOVA and JFP shows that St. Maarten could have acquired money to rebuilds its airport way sooner.

However, the stumbling block might very well be the commitments made to the Dutch through St. Maarten’s Prime Minister Leona Romeo Marlin and the management of PJIAE. Indications given on Thursday when the presentation was made is that St. Maarten namely PJIAE has to see if they can get out of the commitments made to the Dutch Government.

While VIDANOVA proposed the $240M loan at 4.5% they have not asked St. Maarten to give up any positions as imposed on PJIAE through the Dutch and the US bondholders. Currently, the Dutch installed a CFO at PJAIE that is yet to be screened while they also asked for board members on the Supervisory and management board. So far, only the $20M bridge loan has been given to PJIAE and the constant stalling may take the process to May 2020.

Based on the presentation if PJIAE and the Minister of TEATT accept the proposal through JPF then PJIAE stands to gain in a number ways such as:

• Lower Debt Service

• Less restrictions on PJIAE cash flow

• Fast-tracked execution of the reconstruction activities

• Funding for the expanding activities available on short term

• Attractive long term conditions such as the possibility to pay dividends to shareholder

• Financing parties that are committed to the island of St. Maarten and its growth

• Agents that represent all financing parties

• Local legal system applicable, with local legal rates.

• Faster turn around time due to proximity

• Less periodical administrative burden

• Unburden the key management personnel in order to fully focus on the operations and further development.

It should be noted that VIDANOVA financed in the past St. Maarten Harbor Group of Companies and TELEM, where they also function as a bank for St. Maarten Harbor Group of Companies bond, TELEM, and the Aruba Airport Authority financing.